ChatGPT cites Quest Global.

Not eInfochips.

An independent 40-query audit of eInfochips' visibility in AI-powered search platforms. We tested the exact questions semiconductor buyers ask when evaluating ASIC/FPGA design partners, automotive ADAS vendors, and medical device engineering firms.

You dominate Claude (25% market share) but are invisible on ChatGPT (60% market share).

When a Tier 1 automotive supplier asks ChatGPT "Which firms specialize in ADAS embedded software?"—they see Quest Global, Intellias, and ETAS. Not eInfochips. Your 67.5% visibility on Claude creates false confidence while ChatGPT bleeds revenue. This isn't a content problem. It's a platform architecture problem—and Quest Global (with a LOWER Semrush score) is winning the RFPs you never see.

Methodology

How We Conducted This Xtrusio AEO/GEO Audit

This assessment combines manual buyer-intent testing with Semrush AI Visibility data to provide a complete picture of eInfochips' competitive positioning in answer engines—the platforms where 73% of B2B buyers now begin their vendor research.

Three-Phase Xtrusio Workflow

- Website research: eInfochips.com products, services, case studies, Arrow ecosystem

- Competitor mapping: Quest Global, HCLTech, Ignitarium, Cyient, SARACA, Tessolve

- Developed 3 buyer personas: Enterprise Chip Architect, Med-Tech Product Leader, Automotive Systems Engineer

- Generated 40 discovery-phase questions (no eInfochips brand mentions, buyer language only)

- Tested ChatGPT (GPT-4), Gemini (Advanced), Claude (Sonnet 4.5) in January 2026

- Used standardized prompt: "Answer as if I'm a business professional researching solutions..."

- Collected full text responses + screenshots for evidence

- Citation analysis: ✓ (cited), ✗ (absent), ~ (generic mention)

- Collected Semrush AI Visibility data (Aug 2025 - Jan 2026) for eInfochips + 3 competitors

- Analyzed what topics Semrush tracks vs. our buyer-intent questions

- Calculated weighted visibility: (ChatGPT × 60%) + (Gemini × 15%) + (Claude × 25%)

- Market share weights based on B2B usage data (ChatGPT dominant)

Buyer Personas Developed

- "Which firms support TSMC 3nm/5nm?"

- "How to accelerate ASIC verification?"

- "Best partners for ISO 26262 automotive SoCs?"

- "Which firms have ISO 13485 for medical device design?"

- "How to develop FDA-compliant firmware?"

- "Best practices for component obsolescence?"

- "Which companies provide ASIL-compliant hardware design?"

- "How to prototype ADAS on Snapdragon Ride?"

- "Best partners for safety-critical automotive firmware?"

Why This Methodology Works

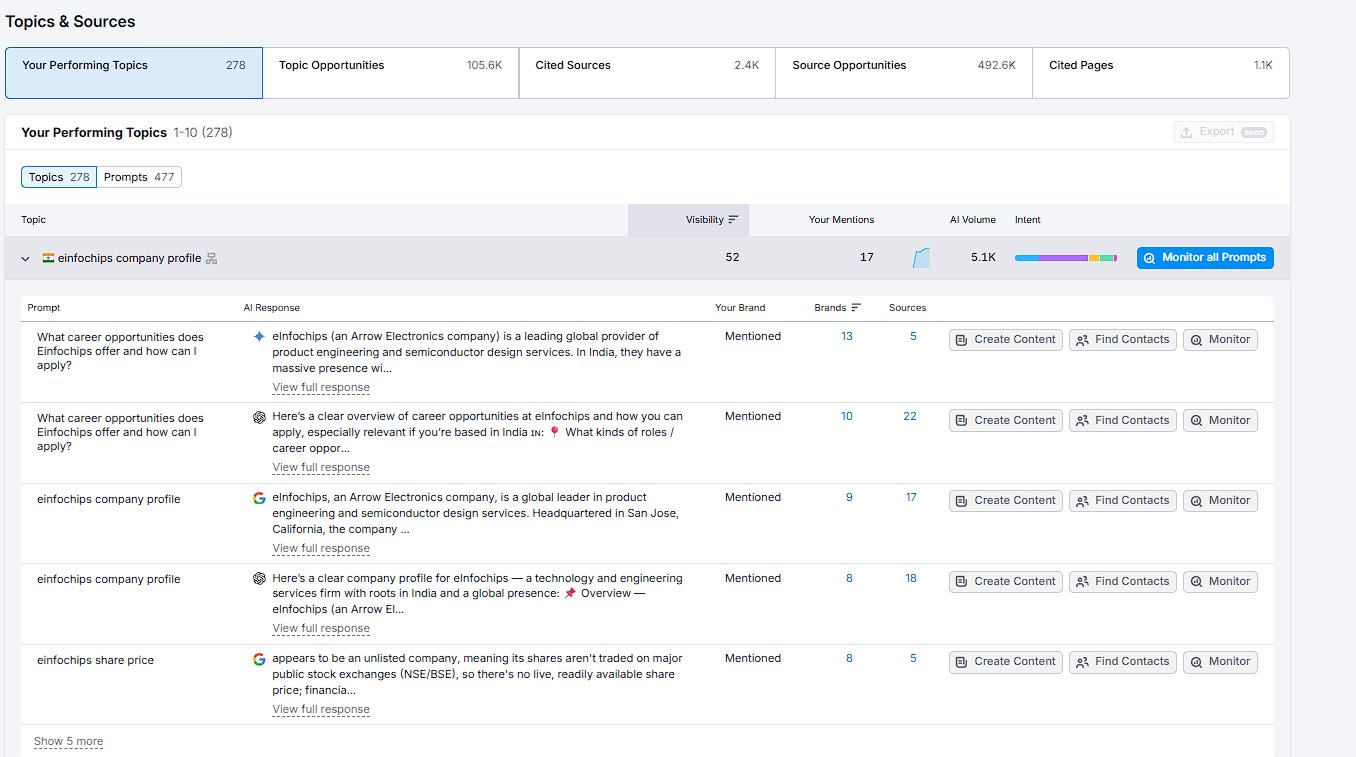

Result: Job seekers ("einfochips careers"), investors ("einfochips share price"), general lookups ("einfochips company profile")

Audience: Recruiters, analysts, journalists — NOT buyers

Result: "Which firms have 200+ ASIC tape-outs?", "Best partners for ADAS embedded software?", "ISO 26262 automotive chip design?"

Audience: VPs of Engineering, CTOs, procurement managers — BUYERS

"Traditional SEO asks: 'How many times does einfochips rank on Google?' Xtrusio Search Intent Architecture asks: 'When a VP of Engineering asks ChatGPT about ADAS partners—does eInfochips appear in the answer?' This is the difference between tracking visibility and engineering revenue."

— Xtrusio AEO/GEO Methodology

Decision-Maker Validation

To validate our personas, we researched 5 real LinkedIn profiles matching our target decision-makers:

| Name | Title | Company | Industry | Persona Match |

|---|---|---|---|---|

| Indranil Ronnie Bose | Partner/CTO Health | Zühlke Group | Medical Devices | Med-Tech Leader |

| Michael Ellison | VP Engineering (former Qualcomm) | 30+ years semiconductor | Semiconductor | Chip Architect |

| Sara Thiele | CTO | Parameters Research Lab | Medical Clinical | Med-Tech Leader |

| Son Ho | Senior VP Engineering | Marvell Semiconductor | Semiconductor | Chip Architect |

| Hussain Rangwala | CTO | Inari Medical | Neurovascular Devices | Med-Tech Leader |

Scope & Limitations

• Discovery-phase buyer intent (before RFP)

• English-language queries

• Semrush AI Visibility comparative data

• January 2026 snapshot

• Post-RFP evaluation ("eInfochips vs Quest Global")

• Non-English markets

• Paid search or traditional SEO rankings

• Social media visibility

Semrush Analysis

Why industry-standard tools fail for niche B2B semiconductor services

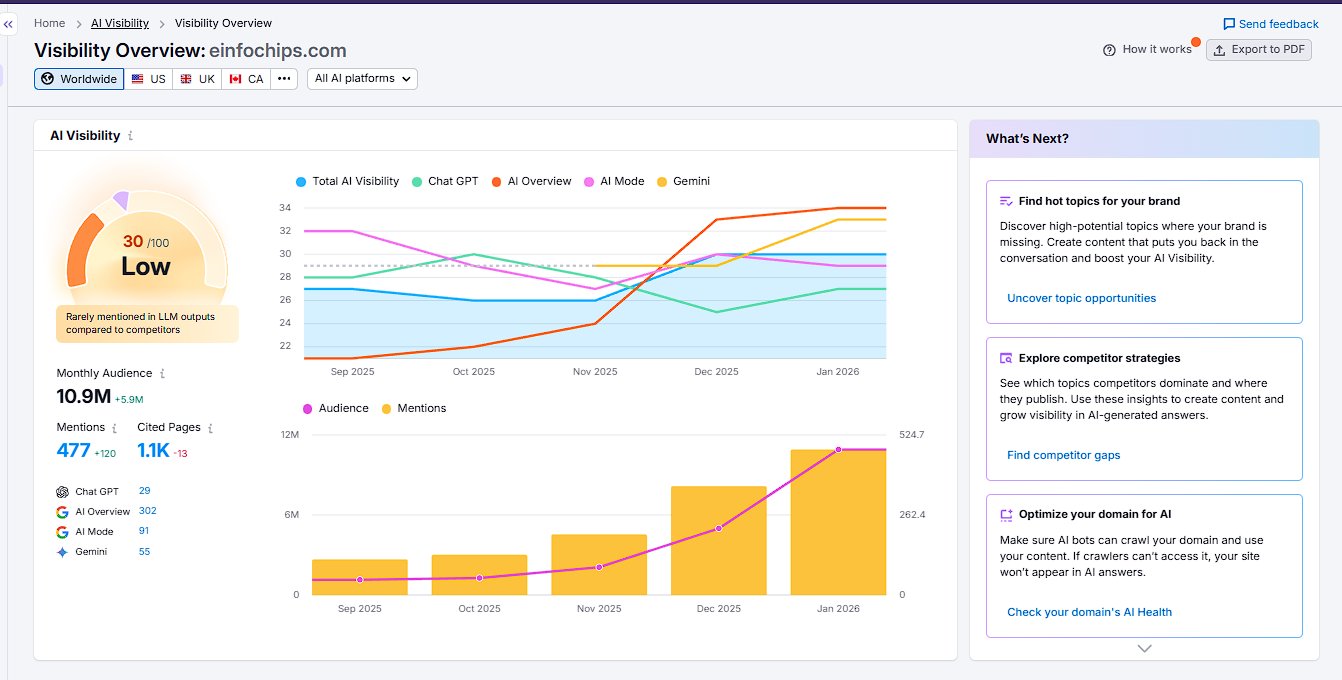

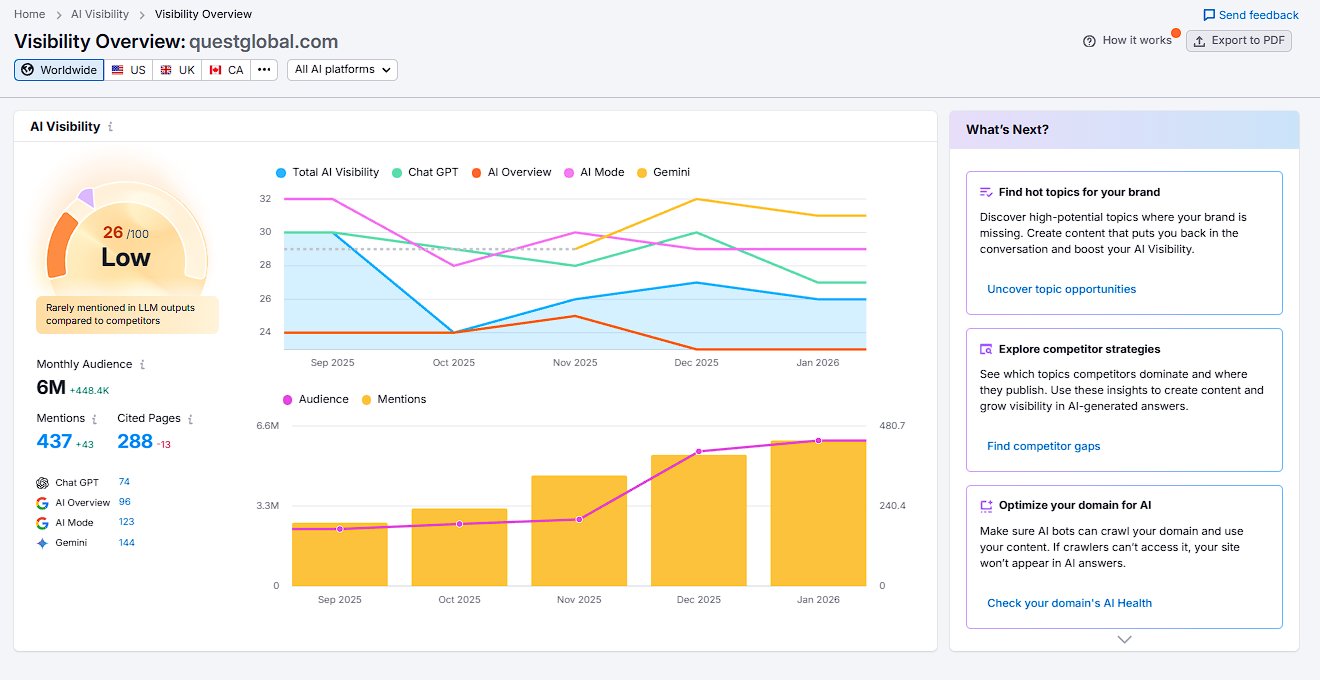

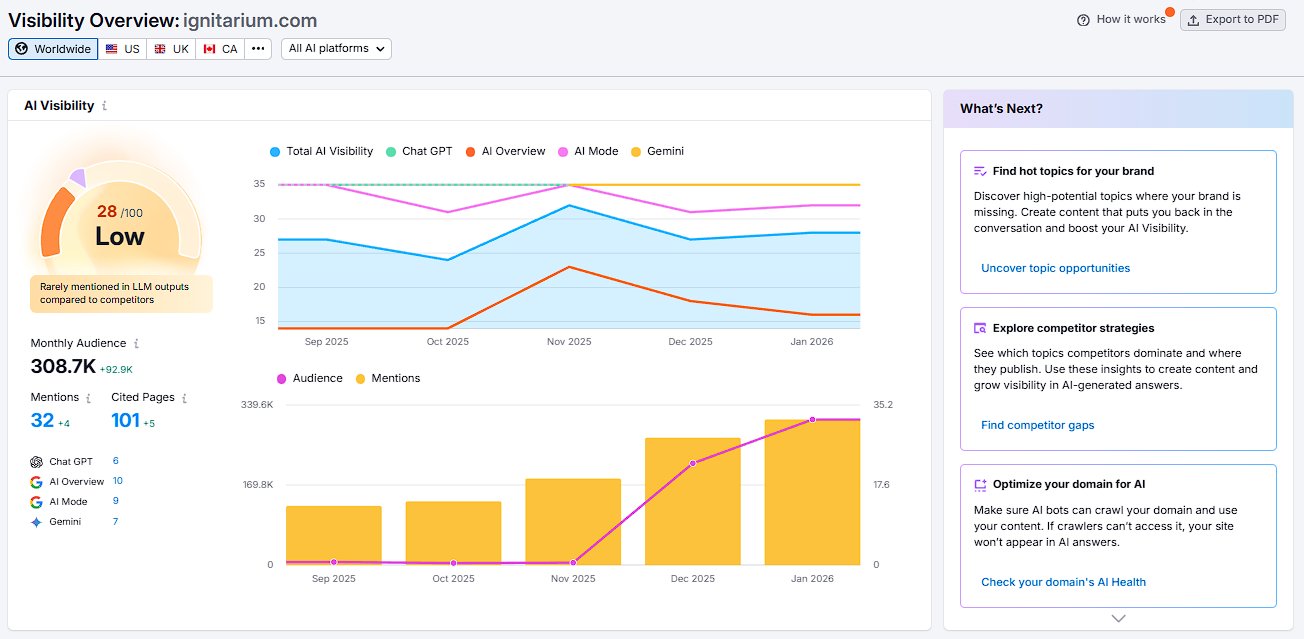

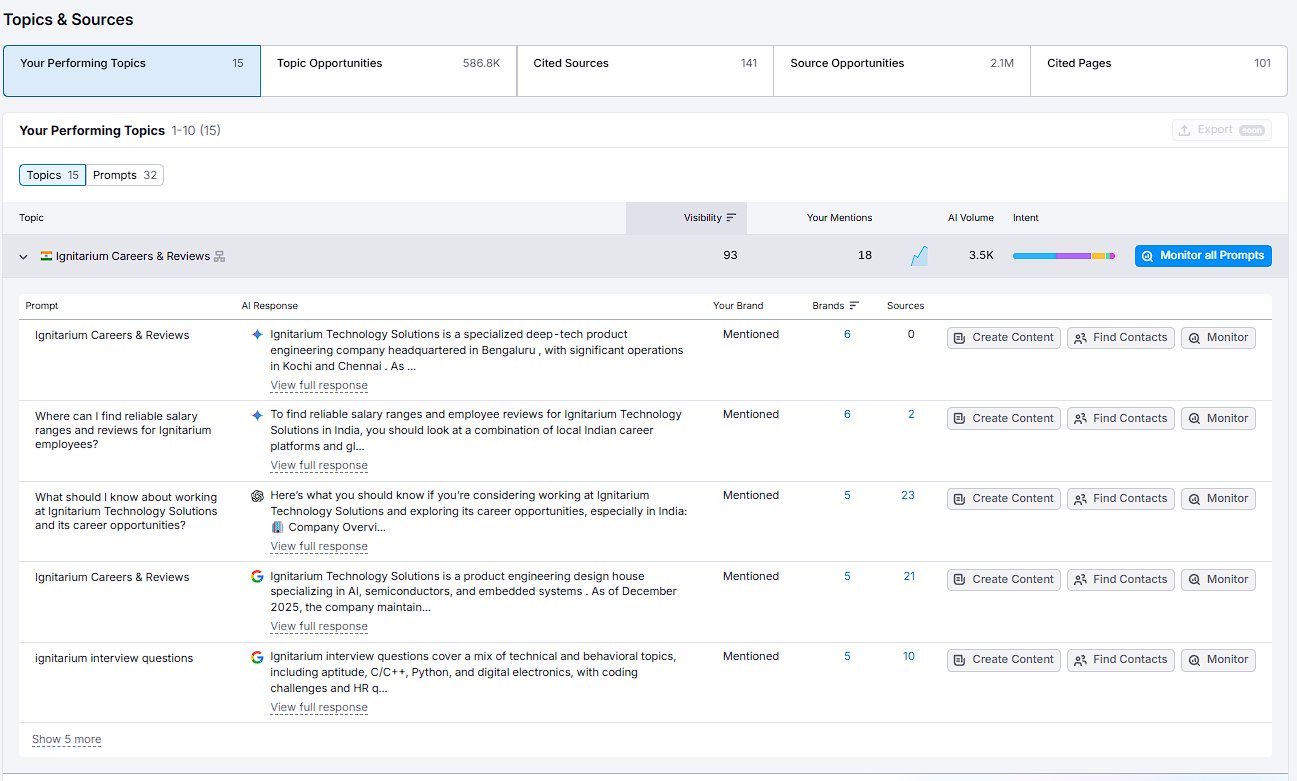

We started with Semrush AI Visibility—the industry standard. What we found explains why automated scores are dangerously misleading for niche B2B brands in the semiconductor design services space.

| Company | Semrush Score | Audience | Mentions | ChatGPT | Gemini |

|---|---|---|---|---|---|

| eInfochips | 30 | 10.9M | 477 | 29 | 55 |

| Ignitarium | 28 | 308.7K | 32 | 6 | 7 |

| Quest Global | 26 | 6M | 437 | 74 | 144 |

All three companies score 26-30/100. All marked "Low - Rarely mentioned in LLM outputs." Yet one dominates ChatGPT with 74 mentions vs eInfochips' 29.

Semrush says eInfochips is "winning" (score 30 vs Quest Global's 26).

Reality: Quest Global dominates ChatGPT with 74 mentions (2.5x eInfochips) and Gemini with 144 mentions (2.6x eInfochips). The platform with 60% of B2B buyers? ChatGPT. Who wins there? Quest Global.

Why? Because Semrush tracks word matches ("einfochips" appears anywhere), not buyer intent ("Which firms specialize in ADAS?"). The data is polluted with job seekers, investors, and general research—not procurement managers.

eInfochips: What Semrush Actually Tracks

| Semrush Top Topic | Visibility | Mentions | Buyer Intent? |

|---|---|---|---|

| "einfochips company profile" | 52 | 17 | NO |

| "What career opportunities does Einfochips offer" | — | 13 | NO |

| "einfochips share price" | — | 8 | NO |

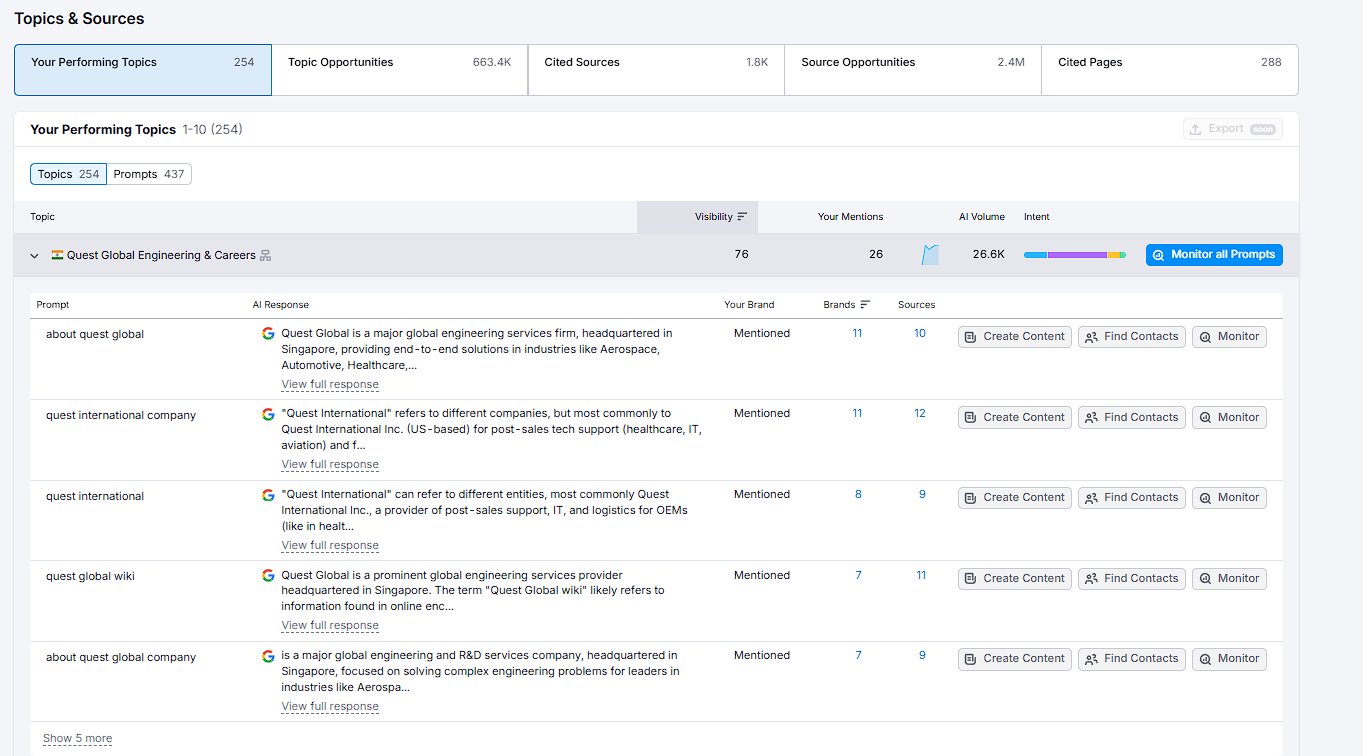

Quest Global: Lower Score, Higher Buyer Reach

• ChatGPT (60% of B2B buyers): Quest Global 74 mentions vs eInfochips 29 (2.5x advantage)

• Gemini (15% of B2B buyers): Quest Global 144 mentions vs eInfochips 55 (2.6x advantage)

Semrush's score says eInfochips is "winning." Reality says Quest Global owns the RFP shortlist before you even know it exists.

Ignitarium: "Better" Score, Zero Buyer Visibility

This proves Semrush rewards high-volume topics regardless of commercial intent. Job seeker queries inflate scores while buyer-intent queries go unmeasured.

"Semrush tracks job seekers asking about 'career opportunities.' Xtrusio tracks CTOs asking 'Which firms can tape out a 3nm SoC?' That's the difference between measuring noise and measuring revenue."

— Why We Built This Manual 40-Query Audit

Platform Scorecard

eInfochips citation rates across AI platforms

Weighted buyer visibility: 26.63% (ChatGPT 15% × 60%) + (Gemini 5% × 15%) + (Claude 67.5% × 25%)

Compare to Quest Global: 44.75% weighted visibility — they win RFPs before you even know they exist.

The ChatGPT Gap

Who gets cited instead on the platform that matters

When semiconductor buyers ask ChatGPT about ASIC design, ADAS development, or medical device engineering, they don't see eInfochips. They see Quest Global, HCLTech, Cyient, and Tessolve.

| Critical Query Where eInfochips is Absent | Who ChatGPT Cites Instead |

|---|---|

| Q2: "Which firms specialize in ADAS embedded software?" | Intellias, ETAS, Quest Global |

| Q4: "Silicon-to-software product engineering partners?" | HCLTech, GlobalLogic, Accenture |

| Q8: "Best firms for ASIC/FPGA design and verification?" | MosChip, Orthogone, Fidus |

| Q18: "Semiconductor design partners with 200+ tape-outs?" | Tessolve, Mobiveil, Cyient |

"By the time a procurement manager Googles 'eInfochips'—you've already lost. They discovered Quest Global through ChatGPT three weeks ago during their discovery phase. The RFP shortlist was set before you knew the opportunity existed."

— The Discovery Phase Problem

AI Positioning Audit

40 buyer-intent queries tested across ChatGPT, Gemini & Claude

| Query Tested | ChatGPT | Gemini | Claude |

|---|---|---|---|

| 1. Which firms help medical device companies meet FDA 510(k) requirements? | ✓ | ✗ | ✓ |

| 2. Which firms specialize in embedded software for automotive ADAS systems? | ✗ | ✗ | ✓ |

| 3. How can medical device companies find partners with hardware + regulatory expertise? | ✗ | ✗ | ✓ |

| 4. What are top companies offering silicon-to-software capabilities? | ✓ | ✗ | ✓ |

| 5. Which firms provide outsourced engineering for connected IoT products? | ✗ | ✗ | ✓ |

| 6. How to evaluate engineering partners for ISO 26262 functional safety projects? | ✗ | ✗ | ✓ |

| 7. What companies offer turnkey development from concept to manufacturing? | ✗ | ✗ | ✓ |

| 8. Which providers have strong ASIC and FPGA design capabilities? | ✗ | ✗ | ✓ |

| 9. How can automotive suppliers find partners with ASPICE Level 3 certification? | ✗ | ✗ | ✓ |

| 10. What are best practices for selecting a product engineering outsourcing partner? | ✗ | ✗ | ✓ |

| 11. Which companies provide digital transformation for industrial equipment manufacturers? | ✗ | ✗ | ✓ |

| 12. How to find firms that develop both hardware and cloud platform for IoT products? | ✗ | ✗ | ✓ |

| 13. What companies specialize in aerospace and defense systems development? | ✗ | ✗ | ✓ |

| 14. Which firms offer quality engineering services with test automation? | ✗ | ✗ | ✓ |

| 15. How can consumer electronics companies find partners for rapid development? | ✗ | ✗ | ✓ |

| 16. What companies provide embedded systems engineering for EV charging infrastructure? | ✗ | ✗ | ✓ |

| 17. Which engineering firms have expertise in developing AI-enabled medical devices? | ✗ | ✗ | ✓ |

| 18. How to select an engineering partner for semiconductor design and verification? | ✗ | ✗ | ✓ |

| 19. What are leading companies in engineering R&D outsourcing for Fortune 500? | ✗ | ✗ | ✓ |

| 20. Which companies offer reference designs to accelerate time-to-market? | ✓ | ✗ | ✓ |

| 21. How can startups find affordable product engineering services for prototypes? | ✗ | ✗ | ✓ |

| 22. What companies specialize in wireless connectivity engineering for IoT? | ✗ | ✗ | ✓ |

| 23. Which partners can help with legacy product modernization and redesign? | ✗ | ✓ | ✓ |

| 24. How to find engineering services combining design with manufacturing support? | ✗ | ✗ | ✓ |

| 25. What firms provide DevOps and cloud engineering for connected product platforms? | ✗ | ✗ | ✓ |

| 26. Which companies offer cybersecurity engineering services for IoT devices? | ✗ | ✗ | ✓ |

| 27. How can healthcare companies find partners for digital health platform development? | ✗ | ✗ | ✗ |

| 28. What firms have experience with video and camera system development? | ✓ | ✓ | ✓ |

| 29. Which companies provide design verification services for complex SoCs? | ✗ | ✗ | ✓ |

| 30. How to evaluate engineering partners for AI and machine learning capabilities? | ✗ | ✗ | ✗ |

| 31. What are top engineering services companies in India with global delivery? | ✓ | ✗ | ✓ |

| 32. Which firms specialize in power electronics design for industrial applications? | ✗ | ✗ | ✗ |

| 33. How can manufacturers find partners for predictive maintenance IoT systems? | ✗ | ✗ | ✗ |

| 34. What companies offer product sustenance and lifecycle management services? | ✗ | ✗ | ✗ |

| 35. Which partners provide integrated hardware-software-cloud solutions? | ✗ | ✗ | ✗ |

| 36. How to find firms with experience in smart home and building automation products? | ✗ | ✗ | ✗ |

| 37. What are key criteria for evaluating partners in regulated industries? | ✗ | ✗ | ✗ |

| 38. Which companies specialize in engineering services for the semiconductor industry? | ✗ | ✗ | ✗ |

| 39. How can industrial automation companies find partners for robotics and autonomous systems? | ✗ | ✗ | ✗ |

| 40. What firms have strong partnerships with major silicon vendors like NXP and Qualcomm? | ✓ | ✗ | ✓ |

| eInfochips Hit Rate (40 Queries) | 6/40 (15%) | 2/40 (5%) | 27/40 (67.5%) |

Visibility by Topic Cluster

Performance varies dramatically across technology areas

The Arrow Opportunity

You're Arrow's semiconductor arm—but AI doesn't know it

eInfochips was acquired by Arrow Electronics ($33B revenue) in 2018. This gives you direct early access to Qualcomm Snapdragon Ride, NXP S32, and Nvidia platforms through Arrow's ecosystem. Yet when AI platforms discuss these partnerships, they cite Arrow—not eInfochips.

| Query Where Arrow Gets Cited | Platform | eInfochips Mentioned? |

|---|---|---|

| Q16: "EV charging infrastructure embedded systems partners?" | Gemini | NO |

| Q20: "Qualcomm/NXP reference design ecosystem access?" | ChatGPT, Gemini | NO |

| Q40: "Design partners with early Qualcomm/NXP platform access?" | ChatGPT, Gemini, Claude | YES (Claude only) |

1. Schema Markup: Add

parentOrganization JSON-LD to every eInfochips page2. Content Updates: Change "eInfochips" → "eInfochips, an Arrow Electronics company" in first paragraph of every product page

3. Arrow Backlinks: Get Arrow.com to link to eInfochips.com/arrow-partnership with joint case studies

4. Joint PR: Arrow + eInfochips co-authored content on Qualcomm Snapdragon Ride, NXP S32 design wins

Semrush Reality Check

What Semrush tracks vs. what drives revenue

| What Semrush Tracks | Audience | What Drives Revenue | Audience |

|---|---|---|---|

| "einfochips company profile" (5.1K volume, 17 mentions) |

Job seekers, journalists | "Which firms have 200+ ASIC tape-outs at 7nm?" | VPs of Engineering |

| "career opportunities at eInfochips" (13 mentions) |

Recruiters, candidates | "Best partners for ISO 26262 automotive SoC design?" | Automotive CTOs |

| "einfochips share price" (8 mentions) |

Finance researchers | "Silicon-to-software product engineering partners?" | Product Leaders |

Of the 477 eInfochips mentions in Semrush, fewer than 25 come from actual procurement-intent queries. The rest? Job postings, company research, investor queries. Quest Global's "lower" score (26) outperforms eInfochips' "higher" score (30) because Quest's mentions are buyer-heavy. Semrush can't tell the difference between a recruiter and a $10M procurement manager.

"Semrush tracks 'einfochips careers.' Xtrusio tracks 'Which firms can tape out a 3nm SoC?' That's the difference between measuring noise and measuring revenue."

— Xtrusio Search Intent Architecture

Quick-Win Recommendations

Immediate, short-term, and long-term actions

- Create /semiconductor-design-services/asic-fpga-capabilities/ (Q8: ASIC/FPGA specialists)

- Create /automotive/adas-embedded-software-development/ (Q2: ADAS partners)

- Add

parentOrganization: Arrow Electronicsschema to all product pages - Update homepage first paragraph: "eInfochips, an Arrow Electronics company, provides..."

- Launch /silicon-to-software-engineering/ hub (Q4, Q12: full-stack product engineering)

- Create eInfochips vs Quest Global comparison page (own the narrative)

- Publish 10 blog posts answering ChatGPT gap questions (Q2, Q8, Q18, Q29)

- Create /automotive/iso-26262-asil-compliance/ page

- EE Times / EDN thought leadership: "How Arrow + eInfochips accelerate time-to-market with Qualcomm ecosystem"

- Qualcomm.com / NXP.com joint webinars and case studies (backlinks to eInfochips)

- Update G2, Clutch, GoodFirms profiles with "Arrow company" positioning

- Monthly monitoring: Track ChatGPT visibility for 40 queries, adjust content strategy

Xtrusio AEO/GEO Strategy

Powered by the Xtrusio Organic Growth Engine

This strategy translates audit findings into a structured, actionable roadmap using Xtrusio's six-module methodology. This is where the report transitions from "here's what's broken" to "here's exactly how Xtrusio fixes it."

- Q4 Budget Planning (Sept-Nov): Launch ADAS content 4-6 weeks before automotive OEM budget cycles

- CES / Embedded World (Jan-Mar): Publish Qualcomm/NXP partnership content pre-event

- Computex (May-Jun): ASIC/FPGA capability announcements timed to semiconductor design peaks

- Step 1 - Schema & Text: Wiki-style definition blocks + JSON-LD (SoftwareApplication, FAQPage, HowTo)

- Step 2 - Authority Signals: Backlinks from Arrow.com, Qualcomm partners page, EE Times, TSMC OIP directory

- Step 3 - Content Expansion: Surround each definition with 3-5 supporting articles (Q&A, comparisons, how-tos)

- Priority Pages: "/what-is-asic-design/", "/automotive-adas-software-development/", "/silicon-to-software-engineering/"

- ASIC Cost Calculator: "Estimate your chip development costs" (target 5%+ conversion, answers Q8)

- ADAS Verification Assessment: "Score your ISO 26262 readiness" (Q2, Q30)

- ISO 13485 Compliance Checklist: Medical device design readiness (Q1, Q17)

- Funnel entry points tied to ChatGPT gap queries (Q2, Q4, Q8, Q18)

- Tier 1 - Premium PR: EE Times, EDN, Embedded Systems Design, Semiconductor Engineering (DA 60+)

- Tier 2 - Niche Directories: G2, Clutch, GoodFirms, Gartner Peer Insights with "Arrow company" positioning

- Tier 3 - Ecosystem: Qualcomm Design Partners directory, NXP Connects, Arrow.com/einfochips dedicated page

- All placements echo same definition language as eInfochips.com (AI gains confidence when multiple authorities agree)

- Week 1-2: ADAS embedded software page (Q2: 0% ChatGPT → target 70%)

- Week 3-4: Silicon-to-software hub (Q4: 15% ChatGPT → target 80%)

- Week 5-6: ASIC/FPGA capabilities (Q8: 0% ChatGPT → target 75%)

- Week 7-8: Qualcomm/NXP partnership showcase (Q40: strengthen Claude, expand to ChatGPT)

- Internal linking: All new pages link to "/arrow-partnership/" to build topical authority

- Lead capture flows for ASIC calculator, ADAS assessment, ISO 13485 checklist

- Email sequences by persona: Chip Architect (semiconductor focus), Med-Tech Leader (regulatory compliance), Automotive Engineer (ASIL/functional safety)

- CRM integration: Tag leads by entry point (which gap query brought them)

- Retargeting: Visitors who engage with AEO-optimized content but don't convert

Xtrusio Results Projection

| Metric | Current (Audit) | 3-Month Target | 6-Month Target | 12-Month Target |

|---|---|---|---|---|

| ChatGPT Visibility | 15% | 35% | 55% | 70% |

| Gemini Visibility | 5% | 25% | 45% | 60% |

| Claude Visibility | 67.5% | 75% | 80% | 85% |

| Weighted Buyer Reach | 26.6% | 43% | 59% | 72% |

| AI-Sourced RFP Leads | ~0/mo | 8/mo | 18/mo | 30/mo |

The Gap is Fixable. The Window is Now.

Activate Your Xtrusio Growth Engine Before Quest Global Widens the ChatGPT Lead